Scientific Advances: Catalyst for Biotech Investment and Innovation in Clinical Development

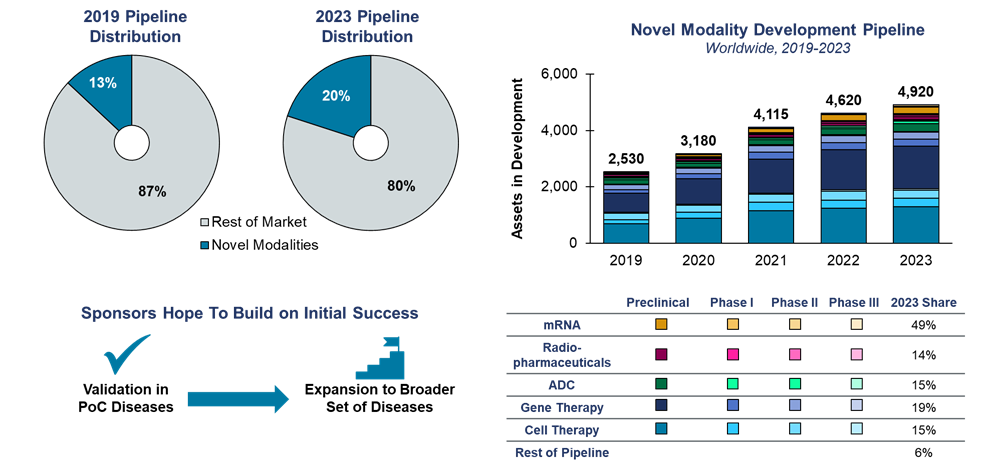

Significant scientific advances are creating a rich array of opportunities for biopharmaceutical companies to innovate. Many are expanding novel modalities into a more expansive range of therapeutic areas beyond the initial successes and are increasingly willing to take on risks to tap into larger and more diverse markets with unmet needs.

A rapidly growing development pipeline

The clinical development pipeline has grown steadily at about 7.5% annually over the past five years. During that time, investment in clinical development has nearly doubled in modalities, including cell and gene therapy, mRNA, radiopharmaceuticals, and antibody-drug conjugates (ADCs).

Note: Novel modalities include mRNA, radiopharmaceuticals, antibody-drug conjugates, and cell/gene therapies.

Source: Health Advances interviews and analysis, Pharmaprojects.

The key question facing developers is determining what these modalities can achieve beyond their original “sweet spots” – for example, beyond monogenic to polygenic and even idiopathic diseases. The next five years will bring important insights as sponsors progress. Let’s take a look at a few areas where interest and activity are keen.

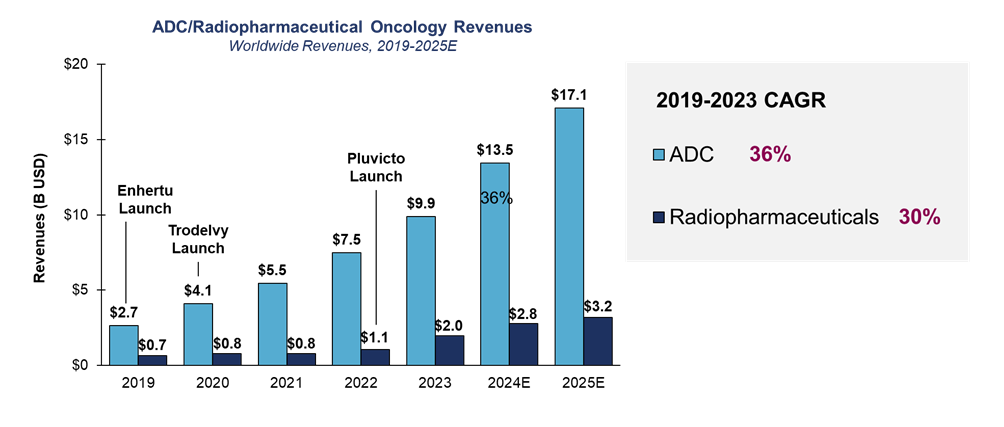

Novel treatments for oncology: ADCs and radiopharmaceuticals

While ADCs are not new, first approved almost 25 years ago, some recent successes have reignited the ADC space. With a projected 30% annual growth sales trajectory, ADCs are drawing a great deal of investment. The key question is whether the technology can be successful beyond cancers with highly expressed or overexpressed antigens. ADC technology may well become more broadly applicable, with diversification across oncology, thanks to key innovations including better linkers, pro-body conjugates activated by tumor microenvironments, and novel payloads.

Although the market is smaller, radiopharmaceuticals are another fast-growing class within oncology, attracting record-high venture capital funding in 2023. Innovation is focused on developing novel isotopes that increase efficacy with lower tissue penetration and toxicity. However, as they near pivotal trials and launch, developers face critical questions around complex supply chain and distribution issues. Relatively few clinical sites are capable of handling administration; likewise, there are not many isotope manufacturers, and the short half-life of isotypes requires just-in-time distribution. Careful evaluation and planning will be crucial to overcome these barriers.

Source: Health Advances interviews and analysis, EvaluatePharma, Pharmaprojects.

Source: Health Advances interviews and analysis, EvaluatePharma, Pharmaprojects.

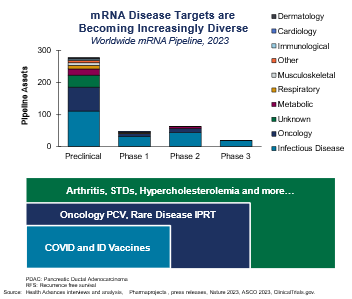

Personalized cancer vaccines: mRNA

We are seeing mRNA sponsors expand from success in infectious disease to oncology and personalized cancer vaccines.

Critical technology enablers have driven progress in cancer vaccines. Advances in the speed and accuracy of molecular profiling have helped companies determine the right neoantigens for experimental cancer vaccines. The ability to multiplex RNA molecules (not possible with protein vaccines) has led to vaccines that increase the chances of provoking an immune response.

Since these drugs change for every patient based on their tumor neoantigens, sponsors will need to demonstrate to regulators a strong manufacturing and supply chain network capable of delivering them. We advise engaging early with regulators before beginning pivotal studies.

Breakthroughs in rare disease: gene therapy

In gene therapy, we celebrate successes in rare diseases, including the first approvals in sickle cell and hemophilia. While there is increased confidence in gene therapies, investors are placing more value on lead programs, vs platforms, with a clear path to commercial viability. The development will likely diversify from rare monogenic to polygenic diseases and other areas of unmet need, such as cardiology and oncology.

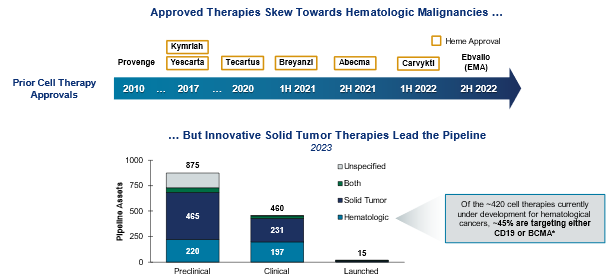

Treatments for hematology and solid tumors: cell therapies

Cell therapies are well established in hematology, with numerous approvals in recent years. Future development efforts are focused on broadening the application of these therapies to solid tumors, where there is more opportunity for target diversification and innovation. With a wealth of pipeline assets in development for solid tumors, which are far more prevalent than hematological indications, we are hopeful for the potential of new treatments.

*Includes dual-targeting approaches that could provide improvement on existing approaches.

Source: Health Advances interviews and analysis, Pharmaprojects.

Innovative uses of data science

Investments in data science-driven tools support all these novel modality innovations and therapeutic area developments. With more innovative ways to capture and analyze data, we are enabling more effective patient identification and segmentation for clinical development. For example:

- In oncology, radiomics companies are using AI-based algorithms to read scans from metastatic cancer patients undergoing system therapy to determine responses on a lesion-by-lesion basis. This could enable novel development and therapeutic approaches building on highly localized strategies at progressing lesions.

- In neurology, recent studies have leveraged natural language processing and speech recognition advances to utilize lexical-semantic and acoustic measures as digital biomarkers for Alzheimer’s disease. These new biomarkers can better identify new cases of mild cognitive impairment, allowing for earlier intervention and improving chances of success in clinical trials.

- In rare diseases, data science has enabled novel prediction models for wild-type transthyretin amyloid cardiomyopathy (atATTR-CM) heart failure patients. This enables providers to rapidly identify patients with this rare and underdiagnosed disease and enroll them in trials.

Source: Health Advances analysis, Market for AI Healthcare Kalaroma 2019, Pfizer press release, Alzheimers Dementia 2023 Goldstein.

Source: Health Advances analysis, Market for AI Healthcare Kalaroma 2019, Pfizer press release, Alzheimers Dementia 2023 Goldstein.

Critical downstream issues for consideration

Innovation and breakthroughs usher in both tremendous opportunity and complexity. Many downstream issues will need to be considered early by innovators as they progress in development. For example, in manufacturing, radiopharmaceutical and CAR-T companies have complex supply chain issues that are critical to solve to ensure both clinical and commercial stage supply. On the regulatory front, personalized cancer vaccine sponsors face some uncertainty around how regulatory agencies will judge the results of individualized therapies where the drug composition is dependent on algorithmic tumor-sequencing analysis. Finally, for market access, companies need to work closely with payers to determine how to pay for gene and cell therapies as they are used to treat ever broader indications.

How we can help

Our strong team of commercial strategists, clinicians, former regulators, and market access experts can partner with you to de-risk your drug development and illuminate the path to commercial success. It is an exciting time for the industry, and we look forward to joining you in the journey to bring important innovations to patients.

Let Parexel Biotech connect every step of development with you. Get the flexibility and adaptability it takes to impact patient lives. Connect with us today